Compass World: 𝅘𝅥𝅮 Oh Africa 𝅘𝅥𝅮 by Akon, feat. China

Kalk Bay station in Cape Town, South Africa, 2006 (Wikimedia Commons)

Toss AKoin to your Witcher

Akon may not be charting on the Billboards Hot 100s, but just because he is out of the limelight does not mean that he has taken it easy in retirement. As he stated in an interview with Business Insider, “One of my biggest fears was just being known for singing and dancing.” He has taken strides to make sure that doesn’t happen. Late last year, a company led by the Grammy-nominated singer, White Waterfall LLC, signed a deal to finance a copper and cobalt mine in the DRC in a joint venture with state mining company SODIMICO.

The R&B artist has also delved into cryptocurrency. In August 2020, Akon launched AKoin, stating, “This coin is focused specifically on Africa,” in hopes that it would be utilized as an alternative to currencies destabilized by runaway inflation or corrupt governments on the continent. AKoin is currently selling at around $0.50 on cryptocurrency marketplaces. Earlier this week, the coin launched a success pilot implementation test at the $2 billion Mwale Medical and Technology City in Kenya. By the end of the 2021 pilot program, AKoin is expected to service more than 20,000 workers within the complex. Akon hopes to expand the project, with Akoin serving as the exclusive currency of Akon City, a $6 billion dollar project 62 miles away from Dakar, Senegal.

Blinded by the Lights

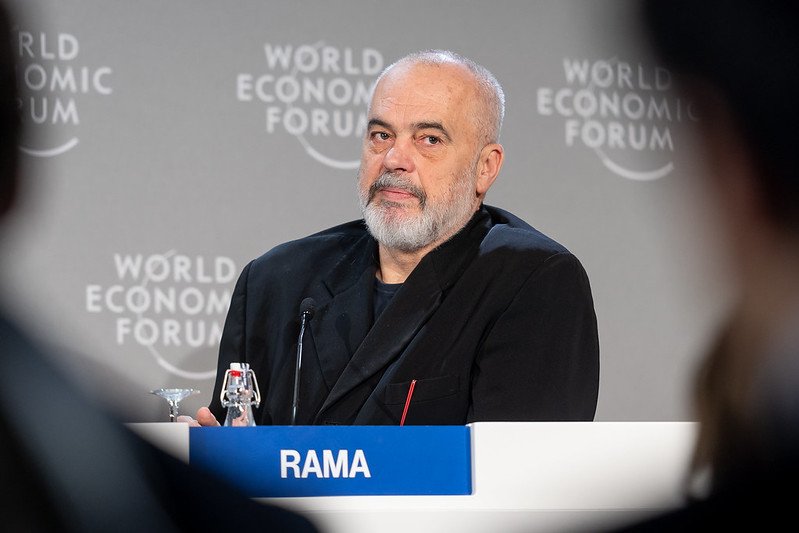

Akon at Web Summit in Lisbon, Portugal, 2019 (Flickr)

Akon launched another project, Akon Lighting Africa (ALA), in 2014 with a $1 billion line of credit from industrial conglomerate China Jiangsu International. CJI became interested in the venture after American and European tariffs made it too expensive to sell Chinese solar technology to the West.

This makes up only a small part of Sino-African trade, which tops $200 billion per year. The continent has been a huge hotspot for Chinese investments. Since 2011, China accounts for 40 percent of investment for infrastructure on the continent, and at the 7th Forum on China-Africa Cooperation in 2018, President Xi Jinping pledged more than $60 billion in financing for projects across Africa.

𝅘𝅥𝅮 Locked Up 𝅘𝅥𝅮 in Debt!

President Cyril Ramaphosa hosts President Xi Jinping of the People’s Republic of China on a State Visit to South Africa, 2018 (Flickr)

With Chinese investments flowing to infrastructure projects such as ALA, there are some fears among Western policymakers that the CCP will use debt accumulated from some projects to control developing countries. For example, in 2017 the Sri Lankan government, unable to repay China for the construction of a new port in the city of Hambantota, signed over the port to China as a strategic base.

Chinese infrastructure investments have been costing their host countries. The new Chinese-built train line to the Rift Valley in Kenya lost $90.3 million in its first year of operation in its first year and $200 million over its first three years of operation. While Kenya was able to negotiate a debt suspension to China early this year, the country’s debt obligation to China now amounts to $4.7 billion. Some have gone so far as to call what China is doing as a new form of colonization.

Whether the failures of Chinese infrastructure investments are part of China’s strategic goals or merely a result of incompetence and poor local governance is still under debate. For every example of the failures of Chinese investments like the Mombasa-Nairobi SGR, there are also triumphs like the ALA, which brings electricity to roughly 29 million Africans whose governments have far too often mismanaged resources for development.

We Need to Link Up 𝅘𝅥𝅮 Right Now (Na Na Na)𝅘𝅥𝅮

Despite any infrastructural embarrassments, Africa is key to China’s long-term economic and political stability. Manganese, cobalt, coltan and more than a third of China’s oil imports come from Africa, fueling its industrial base. China also views Africa as a market for its consumer goods. As Akon said “[China] has such a huge economy, that China itself is not big enough for the economy that they built for ‘em.” While Africa remains a vital trading partner for China, maybe your next iPhone will have cobalt provided by Akon.