China’s Economic Growth Hits Record Low

China's economic growth hit a 24 year low at 7.4 percent and missed the government target of 7.5 percent for the first time in 16 years. The slowdown has been blamed on cooling property prices and the crushing debt held by the local provincial governments. China’s slowing growth, however, has been expected. Experts have anticipated this change as China enters a new phase of this type of "normal" growth. They also believe that the economic slowdown will be stable and the overall economic structure to be improving. The central Chinese government does not appear to have any plans to introduce stimulus packages to boost the economy. Yet, despite the optimism displayed by China’s top officials and Chinese experts, there has been an increasing feeling among China’s population that times will get tougher.

China's economic growth hit a 24 year low at 7.4 percent and missed the government target of 7.5 percent for the first time in 16 years. The slowdown has been blamed on cooling property prices and the crushing debt held by the local provincial governments. China’s slowing growth, however, has been expected. Experts have anticipated this change as China enters a new phase of this type of "normal" growth. They also believe that the economic slowdown will be stable and the overall economic structure to be improving. The central Chinese government does not appear to have any plans to introduce stimulus packages to boost the economy. Yet, despite the optimism displayed by China’s top officials and Chinese experts, there has been an increasing feeling among China’s population that times will get tougher.

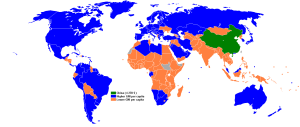

For the past few decades, China’s economy has undergone double digit growth per year. China’s GDP expanded exponentially from 200 billion USD in 1980 to 11 trillion USD in 2015. By analyzing these past trends, it becomes even more surprising to see China miss its growth target. However, stock markets from across the world did not react negatively to the news. Many stock markets had anticipated that the growth would actually be worse and actually rose due to better than expected news. This “optimism”, in addition, has been shared by many of China’s own officials.

Both President Xi Jinping and Prime Minister Li Keqiang have called the slowing growth rate as a “the new normal” for China”. Chinese officials have been struggling for years to transition China's economy to a more stable structure in the midst of a weak housing market, slow international recovery, and low domestic demand. The troubles have been multiplied by the heavy debt incurred by many of the local provincial governments. The National Audit Office in China has estimated local government’s debt to be around 17.3 trillion yuan (approx. 3 trillion USD). The Chinese government responded to these high debt levels by adding restrictions on local government expenditure. As such, the slower growth rate indicates that the Chinese government may be succeeding in its economic transition from an export-driven to consumption-led economy and debt reducing policies.

President Xi’s buoyant feelings have been echoed by many members of China’s business community. Jack Ma, Chairman of Alibaba, said that he would have been extremely surprised if China continued to maintain a 9 percent growth rate. He argued that a fast growth rate would be artificial and further erode China’s environment . Other executives have pointed to the fact that a majority of Chinese continue to have a high savings rate. With more than a 50 percent savings rate (a rate much higher than many Western countries), many Chinese citizens have the potential to invest and grow the economy in the future. A consensus, therefore, has been formed among Chinese experts that China will not implement any major policy changes to stimulate growth.

But, without any major stimulus policies, it appears that the lives of average Chinese citizens will become more difficult. Decades of high growth have buoyed the expectations of millions of China’s middle class. The economic slowdown will mean that the middle class will see slower increases, if not an outright decline in wages. The worst hit will be those working in construction and other manufacturing industries, due to weak domestic demand. The migration trends in China indicate that those employed in manufacturing have started to move to other regions in search of work. Already, the cities in southeastern China, such as Shanghai, Guangzhou, and Nanjing, are overcrowded. Being relatively diversified in terms of industries, these major cities are extremely attractive to those seeking work, and increased migration to these places will no doubt put pressure on public services. As a result, the declining fortunes of manufacturing of construction workers has the possibility to create further migration problems in China.

Any solution China adopts to address slowing growth rates will be incredibly complicated. The last time the economy slowed down in 2008, China implemented a massive stimulus package. The package maintained the growth rates, but it also skyrocketed housing pricing and raised local government debt. As stated earlier, the policy will not be repeated this time around. The solution this time will instead require the Chinese government to use finesse. It will need to invest in unexplored sectors where there can be potential growth, such as film, culture, and sports. By focusing investment in these areas, China may be able to continue growing and offer employment to those affected by the recent slowdown. Doing nothing, however, could result in negative consequences. Many Chinese citizens will be facing hard times perhaps for the first time of their lives. The discontent among large swaths of China’s populations combined with the transitioning economy could in the future pose problems for the Chinese government.